The Foundation's Board of Trustees has fiduciary responsibility for the investment of the Foundation's assets, including the allocation of funds to various asset classes and the engagement of professional investment managers. Currently, the Foundation's Investment Committee oversees the investment program in accordance with established guidelines approved by the Foundation's Board of Trustees.

The Foundation’s investments are managed by outside investment managers who invest according to the investment guidelines established by the Board of Trustees’ Investment Committee. The Foundation’s investment objective is to prudently invest its assets in order to achieve a long-term rate of return sufficient to maintain and grow the assets for the current and future benefit of the University.

The Foundation currently manages over $150 million of assets, including gifts made to endowed funds, expendable funds and deferred gifts:

Expendable Funds

Gifts to expendable funds are immediately available for spending at the request of the University. The investment approach for these funds emphasizes preservation of capital.

Deferred Gifts

Deferred gifts are managed individually according to the investment objective that best satisfies donor needs in terms of payout rate and investment horizon.

Endowed Funds

Gifts to endowed funds are invested in perpetuity to support the educational mission of Portland State University. Gifts to the endowment are pooled together in one investment vehicle structure and are diversified across underlying management sectors, risk factors and liquidity characteristics to achieve the endowment investment objectives.

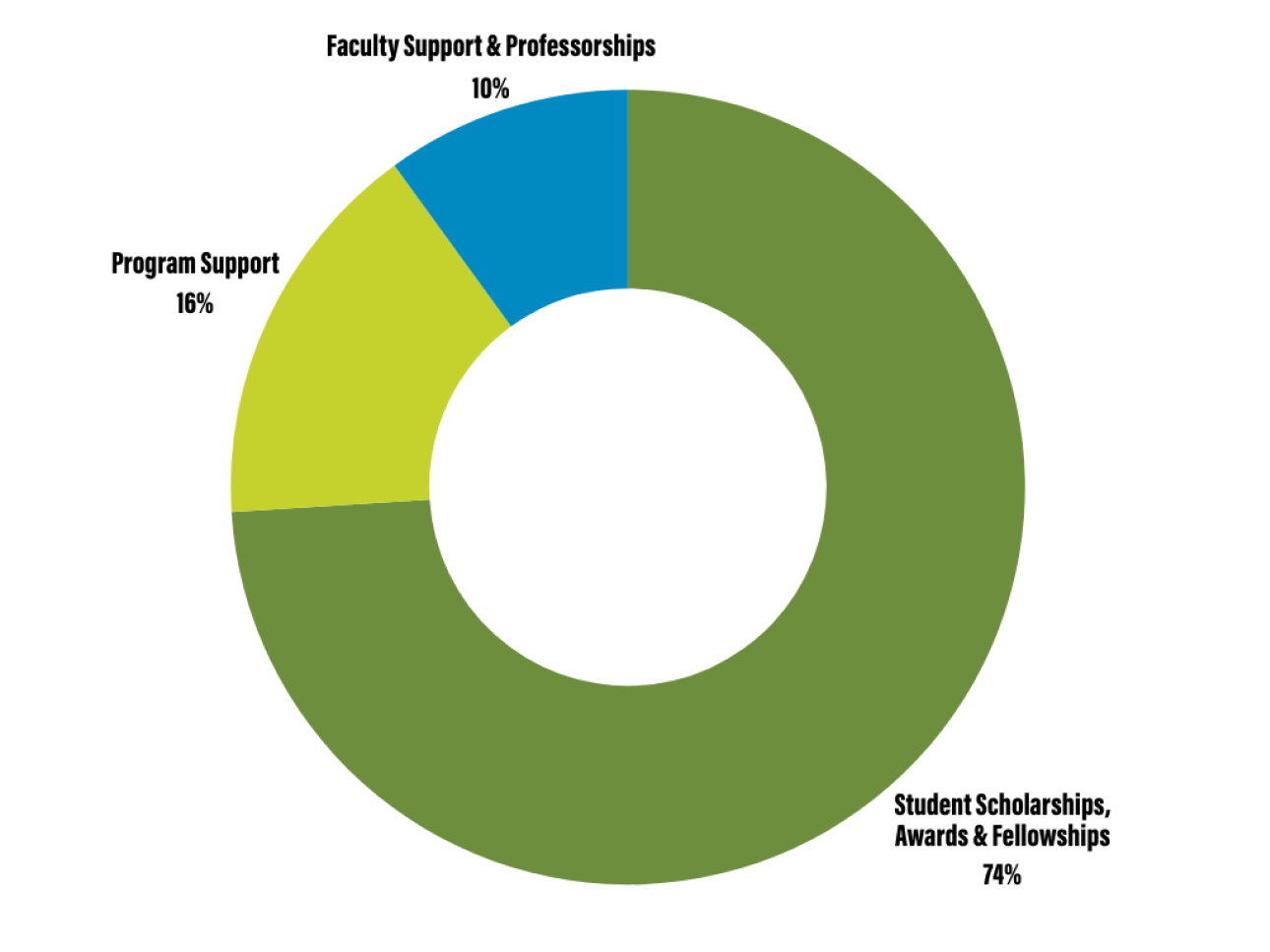

Endowed funds are invested to support student success, faculty success, research and academic programming as follows:

Financial Statements

The Portland State University Foundation's more recent audited financial statements and tax returns are available as indicated below.